I wanted to pass on some interesting information regarding the Election & the Market that I gleaned from a Ned Davis Research webinar on the topic today. Just like 2016, most people are freaking out about who might win. I get emails all time asking whether folks should sell or stay put in their investments right now. To add to that uncertainty, we have Covid-19. I find in times of chaos and uncertainty, looking at data and facts help calm me down. I have synthesized what I think is the most important takeaways from historical data.

- The market has seen similar situations before: Spanish Flu and other contested elections.

- The markets don’t like uncertainty and tend to do better with an incumbent. BUT, post-election the trend reverses and the markets recover. In fact, markets do better under a democratic president (markets up 7.8% (3.79% adjusted for inflation), versus a Republican president (markets up 3.37% (1.28% adjusted for inflation).

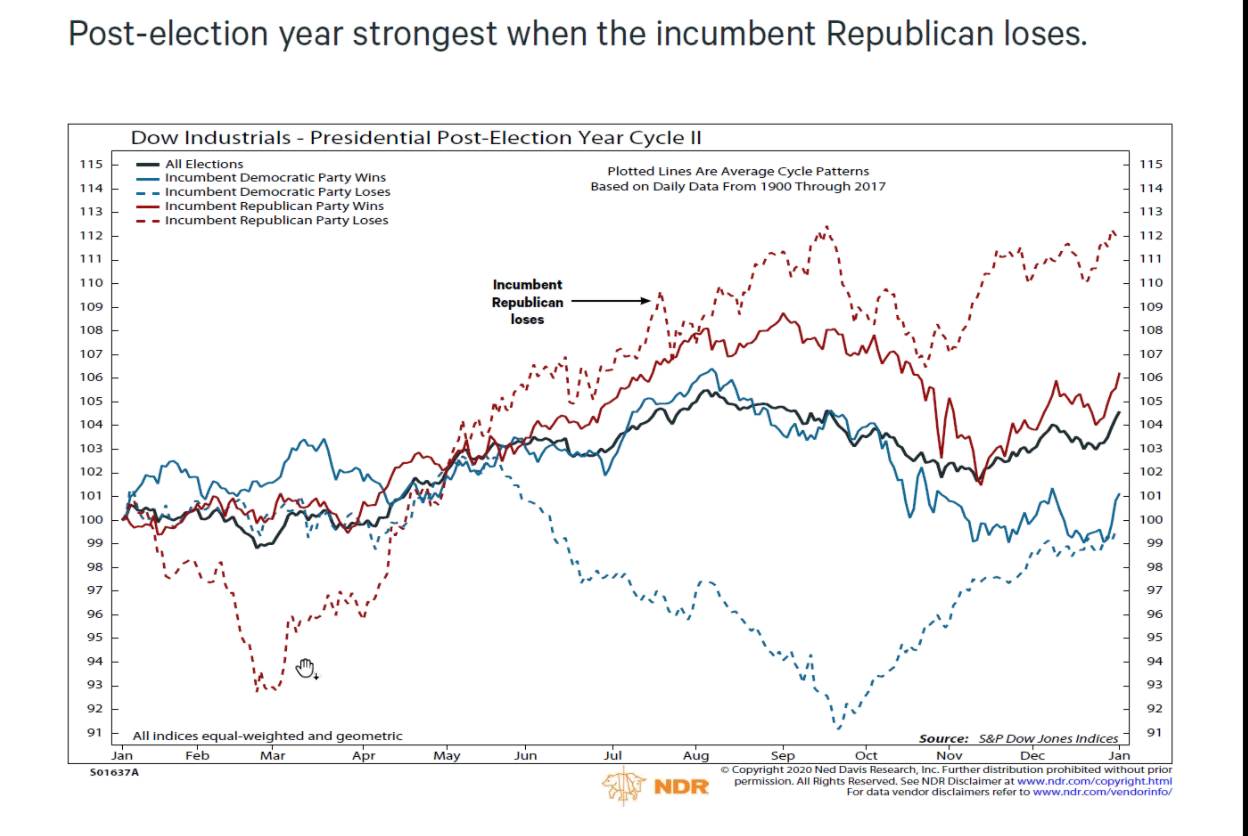

- So, if Trump loses in November the markets will likely go down until 1-2 months into a Biden presidency. By March 2021, the markets should be up and doing well.

- Regardless of who wins, defensive sectors (Healthcare, Financials, Consumer Staples) tend to do well for the months leading up to the election. If Trump wins, defensive sectors should continue to do well. If Trump loses, cyclical sectors will do better.

- Democratic presidents result in cyclical sectors (IT, Communication Services, Consumer Discretionary) outperforming and defensive sectors (Healthcare, Financials, Consumer Staples) under-performing.

- What about Congress? The markets tend to do best when a Democratic president has a split congress (markets up 7.99%). Republicans do best with a Republican congress (markets up 7.09%).

- What about Biden’s policies and the impact on the market?

- Corporate Tax Increase from 21% to 28%- This will impact the sectors that benefited most from the tax cut: Communication Services, Utilities and Financials all had their median tax rate drop 9%+. Energy, materials and Real Estate won’t be impacted much.

- ACA and expanded Healthcare Coverage- As the uninsured rate goes down, the managed healthcare sector outperforms the market. This was seen from 2010 through 2016. Increased health coverage should be good for the sector. This counter balances data showing healthcare prefers a Republican in the White House.

- Infrastructure- This is a very sensitive industry when > 2% of GDP is spent on infrastructure. Trump wants to spend $1-1.5trillion and Biden wants to spend $2trillion on water, transit, broadband, etc.

- Defense and Aerospace would do better under Trump. Under Republican presidents, spending tends to be 60% higher in these industries.

- Fun fact- When the healthcare sector underperforms in the 2nd half of an election year, the incumbent tends to lose. This indicates that Trump should lose.

- Fun fact- High volatility is bad for the incumbent. It is also a bad sign for the incumbent when the market is down following the second party convention; currently it is down 2.8% since the last RNC. This also indicates that Trump should lose.

- Trump could still win with an approval rating < 50 but it is unlikely. It has only happened twice.

- Recessions and bear markets are bad for an incumbent. They lose 80% of the time, and no incumbent has won since 1952 if there is a recession in election year.

Please let this information inspire you to take a deep breath and vote.