“Most Terrifying Experience of My Life”

by Matthew Boyle, Katy Song Financial Planning Summer Intern 2023 It happened in the early morning. My dad got up with what he thought was heart burn, returned to bed, and then was unconscious. My mom called 911, started CPR, and the police arrived first in under five minutes. The ambulance and fire service shortly […]

Is it time to buy an EV?

Tesla, Tesla, Tesla, Rivian, etc… Electric cars seem to be everywhere now. Many families are considering electric cars (EVs) because they are better for the planet and owners are sick of paying high gas prices. They might cost more upfront than regular cars, but they end up being cheaper overall. First, you need to decide […]

What do you want?

I just read Luke Burgis’ “Wanting”, which is excellent (and a little heavy), and I wanted to share with you some ideas to think about before you buy your next anything. He classifies desires (or wants) into two distinct categories: Think and Thin. Thick desires are those that you can explain why you want them. […]

Abundance vs. Scarcity Money Mindset

Most people develop their money mindset at a young age. We see what our parents do with money andwhat they say (or don’t say) about it. And the frame of reference through which we view money as we get older typically falls into one of two camps: scarcity or abundance. What is a Scarcity Mindset? […]

Are You Addicted to Amazon

One-click shopping. Prime delivery. Millions of products. Is there anything not to love about Amazon? But with this easy customer experience and vast selection, it can be tempting to make purchases on Amazon daily. And those purchases can seriously add up, especially for families. A 2019 survey showed a family using Amazon Prime will spend […]

Food Inflation

In 2018, the average family of four in the Bay Area spent $1,200 – 1,600 per month on groceries. In 2022, the average has increased by over 25% to $1,6002,000 per month. Food tends to be one of the top three areas of spending for families after Home and Childcare. How much do you spend? […]

Private vs. Public

The pandemic threw a wrench in education plans for countless families. With public schools closing and shifting to a virtual curriculum, many parents felt stuck between becoming the part-time instructor themselves or finding alternative options, like independent schools. And while the sudden shift toward independent institutions happened quickly, it could prove to be a transition […]

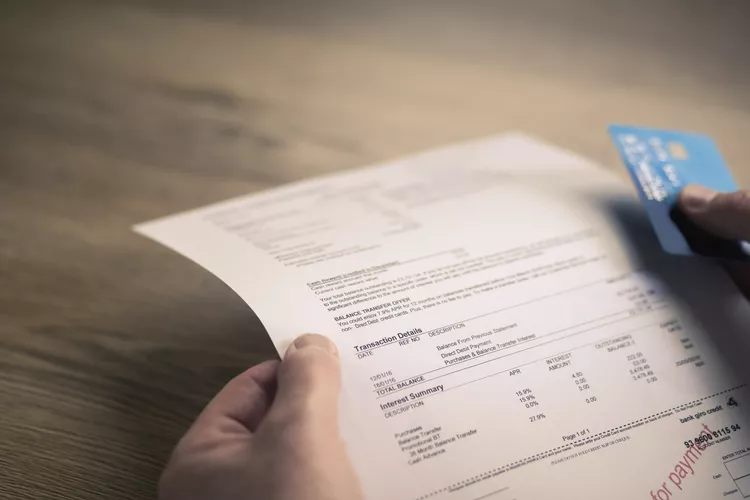

The Monthly Credit Card Bill

For the last few years, I have noticed the creep of my client’s and my own credit card bill balances. Ten years ago, a bill over $8,000 was an outlier. It meant you bought a hot water heater or paid for a week in Hawaii. Nowadays, a bill under $8,000 is a good month. Two […]

Time to Panic

Equity sector relative performance has tended to be differentiated across business cycle phases. Unshaded (white) portions above suggest no clear pattern of over- or underperformance vs. broader market. Double +/– signs indicate that the sector is showing a consistent signal across all three metrics: full-phase average performance, median monthly difference, and cycle hit rate. A […]

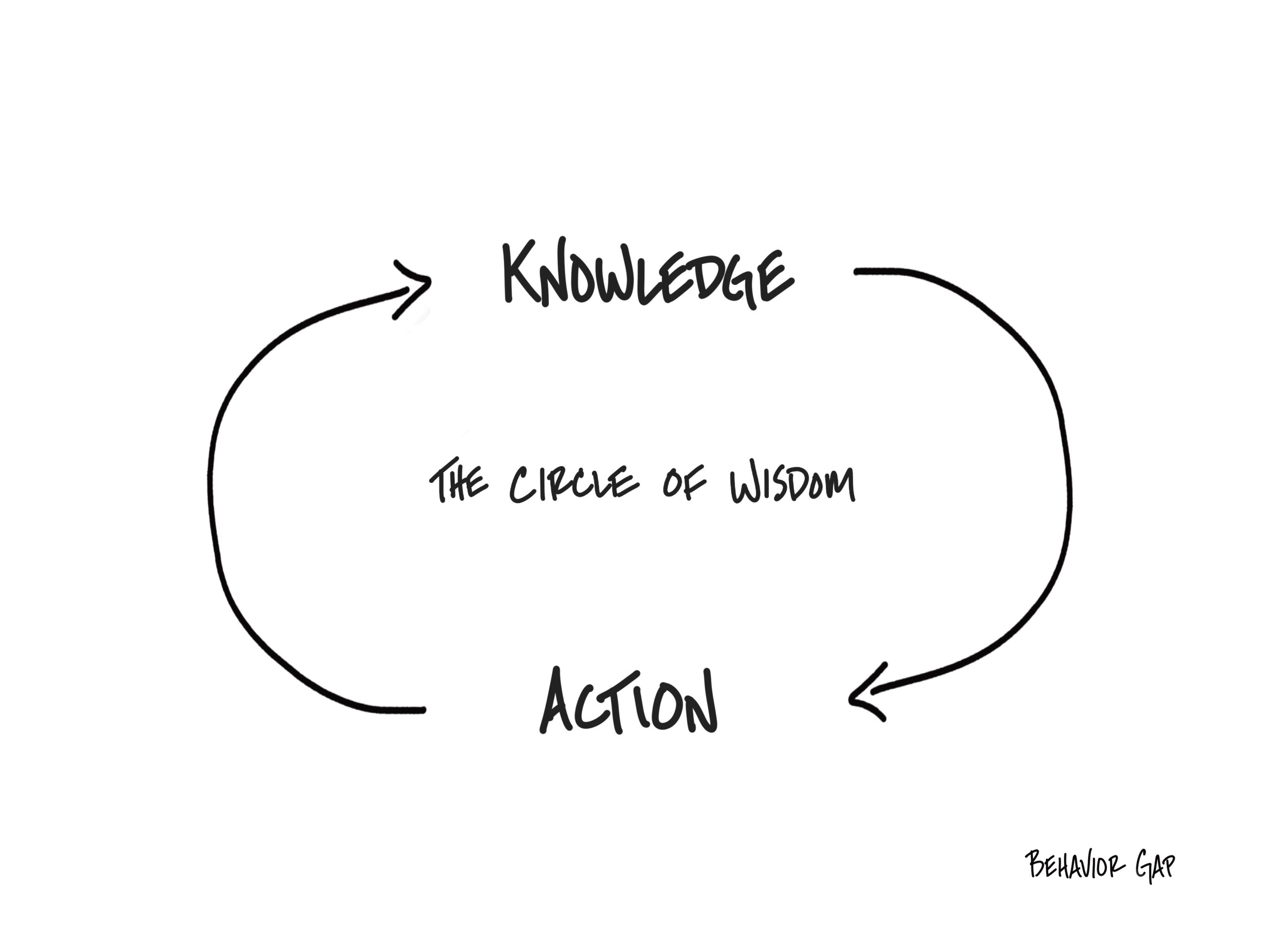

Micro Financial Planning

I help my clients plan for the next 1-5 years. This was considered “short-term” planning in the world of personal finance. However, there is so much uncertainty in the world right now that planning for the future seems like an exercise in fantasy. Think back to a year ago… did you think 2020 would turn […]