Micro Financial Planning

I help my clients plan for the next 1-5 years. This was considered “short-term” planning in the world of personal finance. However, there is so much uncertainty in the world right now that planning for the future seems like an exercise in fantasy. Think back to a year ago… did you think 2020 would turn […]

Time to Refi?

Rates are at lows that I have never seen. The US weekly average rates were 2.71% for a 30 year fixed and 2.26% for a 15 year fixed for the week of 12/10/20. Over the last ten years, you can see on the chart below that these rates are rock bottom for fixed rate loans. […]

The Election & the Market

I wanted to pass on some interesting information regarding the Election & the Market that I gleaned from a Ned Davis Research webinar on the topic today. Just like 2016, most people are freaking out about who might win. I get emails all time asking whether folks should sell or stay put in their investments […]

The Big Win- A Client Story

Christina and Tom are like many couples. They worked hard, built careers, had a baby, saved money and kept thinking about buying a house. Pre-Covid, they had already decided that they were pretty sure they wanted to move to the Boston area to be closer to family and be able to afford a nicer home. […]

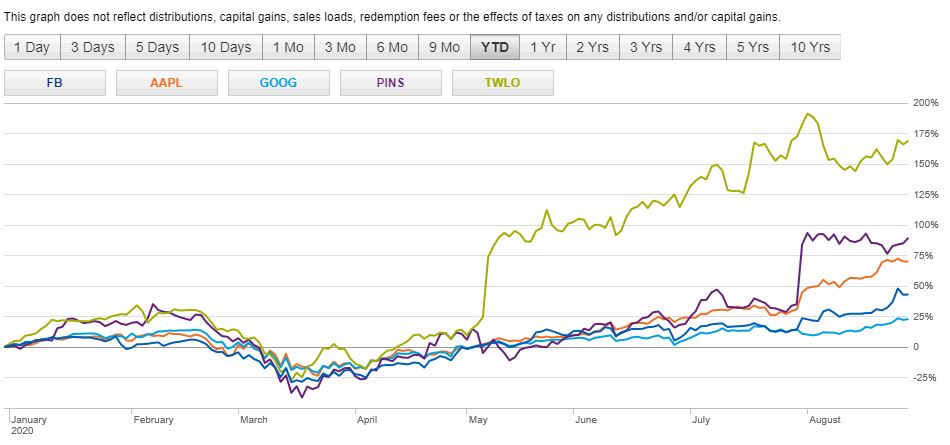

Time to Sell?

My dad always tells me “Trees can’t grow to the sky.” But look at this picture. Despite a continued global pandemic, economic contraction and millions unemployed, the stock market keeps on going. Many of the companies for which my clients work has seen their equity values continue to increase since March 2020. Can this rise […]

45… The Tipping Point to Becoming Debt Free

I turned 45 during confinement. Including a two year break from the workforce for business school, I have been working 20 years. So, I’m halfway through my working years based on retiring at 65. It’s a cliché, but I like what I do and don’t have a desired target retirement date in mind. That said, […]

SINGLE PARENTS & MONEY

Single parents have it harder. There is only one person to do everything. Earn the money, raise the children, be involved in school and the community, do the grocery shopping, sign up for camps… the list goes on and on. Some divorced parents fall into this category as well, and sometimes they have it even […]

HOW MUCH IS YOUR HEALTH WORTH?

Health insurance, co-pays, out-of-network, out-of-pocket, OT, PT, etc. are significant costs for a family. Add to those costs a gym membership, fitness classes and mental health costs and you’re talking a couple of thousand dollars a month. This is doable when you are employed and have a steady paycheck coming in, but Covid-19 has shown […]

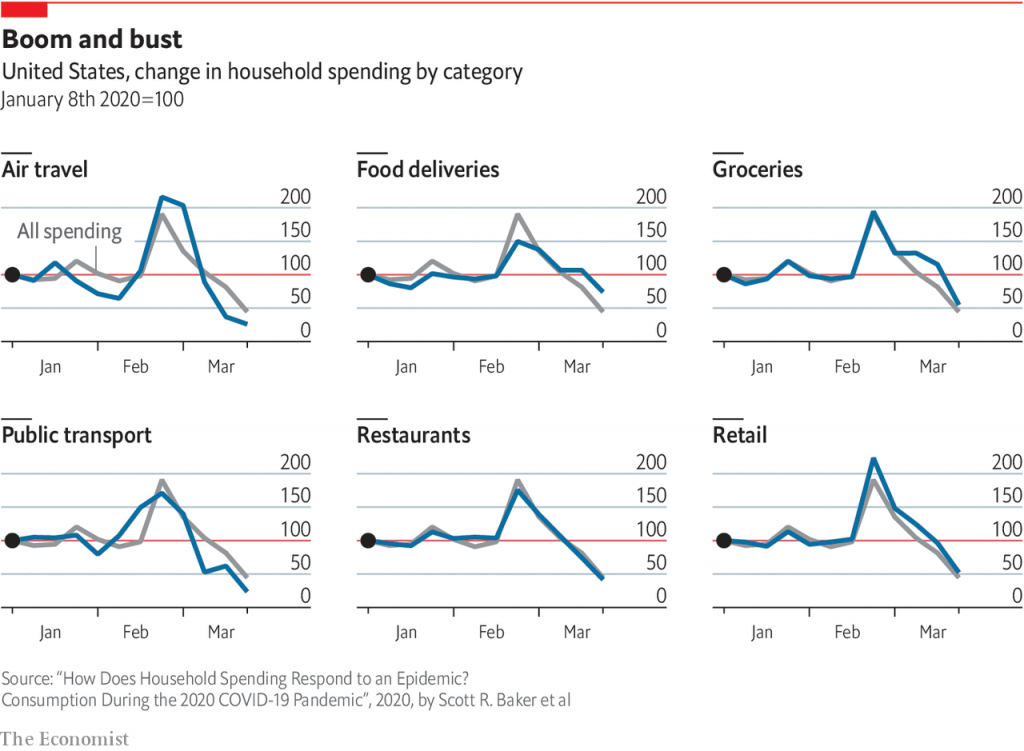

SPENDING IN A PANDEMIC

After a little light reading of “How Does Household Spending Respond to an Epidemic? Consumption During the 2020 COVID-19 Pandemic” from the National Bureau of Economic Affairs, I wanted to share with you some tidbits I found interesting. In late February until mid-March, stores were mobbed with long lines of people stockpiling groceries and other […]

PAYING FOR THE UNEXPECTED

Every year something unexpected comes up. Sometimes it is fun stuff, but usually it’s a broken windshield, root canal or something even more unforeseen. Last summer, I booked us a trip to the Canary Islands for February break. Tickets were affordable, and I was told by my friends in Europe that it was like their […]