Micro Financial Planning

I help my clients plan for the next 1-5 years. This was considered “short-term” planning in the world of personal finance. However, there is so much uncertainty in the world right now that planning for the future seems like an exercise in fantasy. Think back to a year ago… did you think 2020 would turn […]

Time to Refi?

Rates are at lows that I have never seen. The US weekly average rates were 2.71% for a 30 year fixed and 2.26% for a 15 year fixed for the week of 12/10/20. Over the last ten years, you can see on the chart below that these rates are rock bottom for fixed rate loans. […]

The Election & the Market

I wanted to pass on some interesting information regarding the Election & the Market that I gleaned from a Ned Davis Research webinar on the topic today. Just like 2016, most people are freaking out about who might win. I get emails all time asking whether folks should sell or stay put in their investments […]

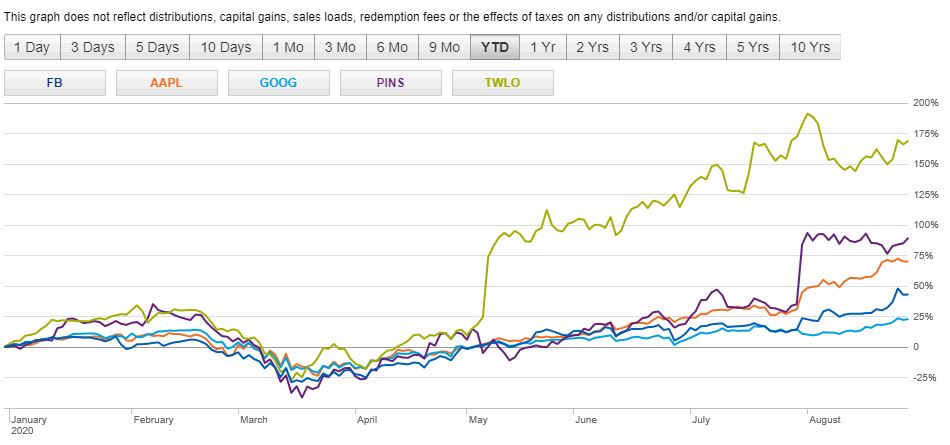

Time to Sell?

My dad always tells me “Trees can’t grow to the sky.” But look at this picture. Despite a continued global pandemic, economic contraction and millions unemployed, the stock market keeps on going. Many of the companies for which my clients work has seen their equity values continue to increase since March 2020. Can this rise […]

Keep On Truckin’

In 2014, I started working with Bill. He wasn’t my typical client. Divorced, dad to two teenage sons, not working in finance, law or technology. He was laid back, and he knew what he loved: his boys, his dog, music and surfing. Financially speaking, he felt like a wreck. He wanted a budget, to get […]

Kids Savings Account- Do they need one?

No, children do not need a savings account but most parents feel like they should open one up as soon as their child gets their first birthday or holiday check. Most of the time, these account balances hover around the same amount of money for years and the bank pays very little interest (like 0.01%). […]