Have Your Cake and Eat It Too- Freelance!

Do you want to work from home? Do you want more flexible work hours? Do you need to make some extra money to afford your desired lifestyle? Maybe it is time to join the Freelance Economy. In almost every industry, freelancing has become popular for professionals looking to take more control over their hours and […]

Smart Frugality

With the holidays approaching and spending about to ramp up, at least for most people, there are ways for you to reign in holiday expenses and save some big money. With Craigslist, eBay, Nextdoor, and innumerable online consignment sites, you do not have to sacrifice quality to save money. I do not like to spend […]

Credit Cards: Friend or Foe

With today’s perks, credit cards can help you earn free flights, hotel stays, gift cards and give you actual cash back. The average cardholder has 3.7 cards in their wallet and carries a balance of over $4,800. Racking up credit card debt can be like putting on holiday pounds; it is quick and can be […]

Take A Paid Vacation

For most homeowner’s in the Bay Area, your home is your largest asset. The great thing about owning a home from a financial perspective is that it is an appreciating asset (goes up in value over time) from which you get utility (you get to live in it!), and you get a tax benefit from […]

Investing in Happiness

Money cannot buy happiness but it certainly impacts it. For some people, they can book a vacation or get a monthly massage without guilt. For most of us, there always seems to be a little nagging feeling that we should not have spent that money on ourselves or our happiness, or that we need to […]

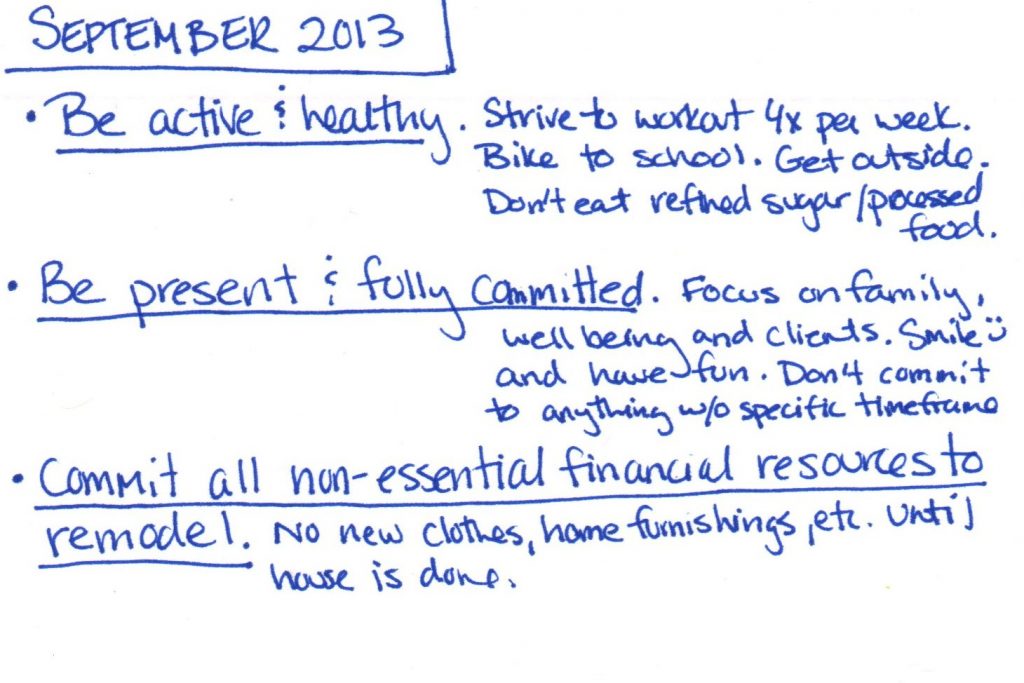

Listen to Your Father

I had the privilege to sit down and speak with the father of one of my clients, who has been very successful in his financial life, and to get his words of wisdom on how to build a solid foundation for a young family’s finances. There was a consistent thread that wove throughout our discussion; […]

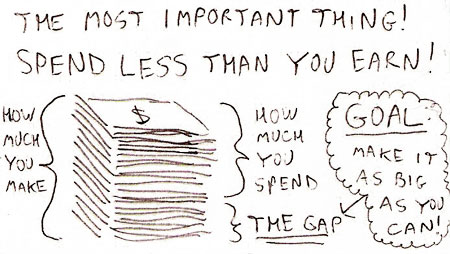

Simple Personal Finance

Money is a heated subject matter. It can bring up feelings of shame, regret, anxiety and even guilt. If you feel any of these, you need to reframe how you see money and start to view it as a tool to get you to where you want to go. Instead of putting or keeping your […]

Prepare for a Wild Ride- The Year of the Horse

The Year of the Horse is expected to be a year of high energy, self-improvement and unexpected adventure. Prepare for a wild ride in 2014 and know what this year will bring for your finances.

The $35 Spin Class

It sounds ridiculous to pay $35 for a 45 minute spin class, right? It is hard to financial justify spending this kind of money when I can go for a bike ride for free. However, does this expense pass my Index Card Test? What is an Index Card Test? In my purse I carry an […]

Money Management On The Go

Five easy steps to On-the-Go Money Management for families that want to know where their money is going.