Money is a heated subject matter. It can bring up feelings of shame, regret, anxiety and even guilt. If you feel any of these, you need to reframe how you see money and start to view it as a tool to get you to where you want to go. Instead of putting or keeping your head in the sand about your family’s finances, I have simplified how to manage your money into three easy rules.

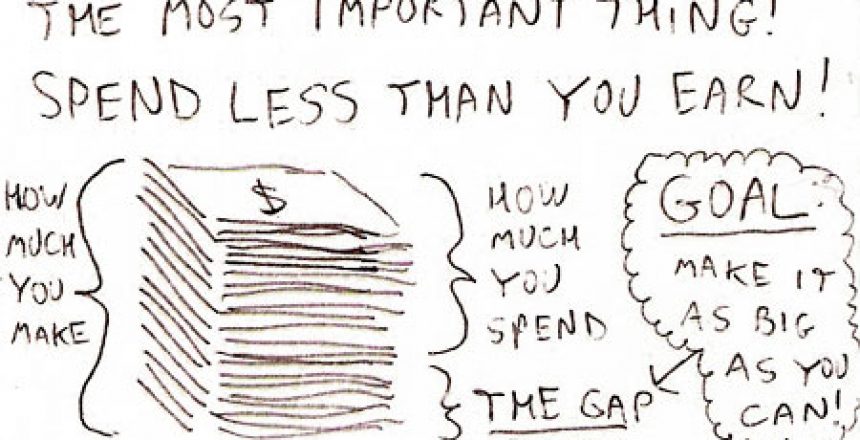

- Spend < Income. It is simple math. When you spend less than you make, there is a gap. By working on either side of this equation (or both), the gap will get bigger. Bigger is better! This extra cash is your ticket to financial freedom.

- Earn More Money. The economic down turn made most people happy to have a job. Now is time to boost your income. The most effective long-term strategy is to create more income streams than your day job. You can do this by creating a side business, earning investment income or even renting out your house the next time you go on vacation. Also, never stop learning new skills. This does not necessarily entail going back to school. If there is something you want to learn, read a book about the topic or attend a seminar. Finally, work towards doing something that you love. When you have passion for something you are more likely to be successful.

- Live Frugally. This does not mean you need to be miserable, but it does mean understanding what matters most to you and making every dollar you spend count. Review your spending and identify habits that are costing you money. For example, eating out is a big one for most families. If you cut $50 per week of eating out and invested that money earning 7%, you would have $68,700 at the end of 15 years. So, the true cost of that $50 dinner is much greater than the bill. Try to not eat out for one month and see how it affects the bottom line. This is pure discretionary spending, so it is important to set a budget for your family and stick to it if you want to reach your goal of financial freedom.

By following these three easy rules you will create a bigger gap. The key is to not spend this cash. Prioritize what you are going to do with this cash. First, pay off all high interest credit card debt. Next, build your Emergency Fund and make sure it is earning interest (0.75% or higher). Then, maximize all pre-tax retirement savings. Finally, start paying off all debts (student loans, car loans and mortgage debt). Most home owners have refinanced in the last year to take advantage of low rates. While this saves you money, you have also extended the term of your loan. If you want to be debt free by retirement, consider accelerating principal repayment with extra cash on hand. If you still have money left over after all of these, save it for your children’s college.