Micro Financial Planning

I help my clients plan for the next 1-5 years. This was considered “short-term” planning in the world of personal finance. However, there is so much uncertainty in the world right now that planning for the future seems like an exercise in fantasy. Think back to a year ago… did you think 2020 would turn […]

Time to Refi?

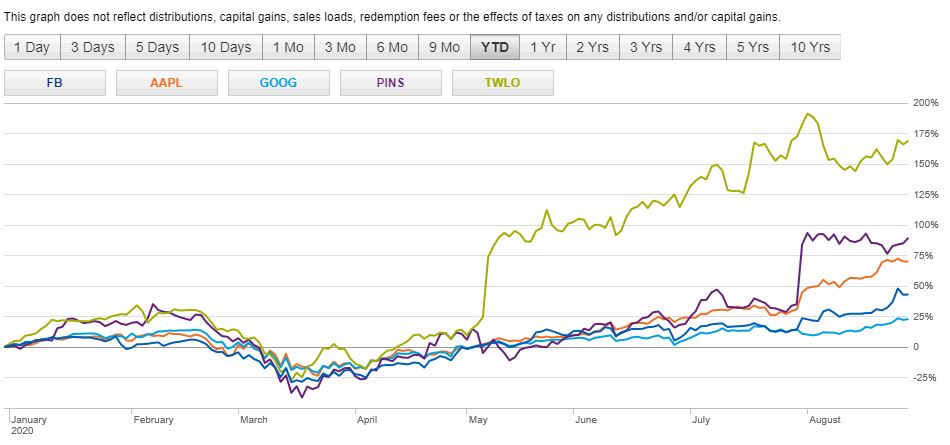

Rates are at lows that I have never seen. The US weekly average rates were 2.71% for a 30 year fixed and 2.26% for a 15 year fixed for the week of 12/10/20. Over the last ten years, you can see on the chart below that these rates are rock bottom for fixed rate loans. […]

Time to Sell?

My dad always tells me “Trees can’t grow to the sky.” But look at this picture. Despite a continued global pandemic, economic contraction and millions unemployed, the stock market keeps on going. Many of the companies for which my clients work has seen their equity values continue to increase since March 2020. Can this rise […]

Simple Personal Finance

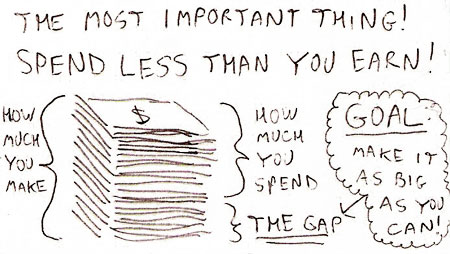

Money is a heated subject matter. It can bring up feelings of shame, regret, anxiety and even guilt. If you feel any of these, you need to reframe how you see money and start to view it as a tool to get you to where you want to go. Instead of putting or keeping your […]

Having versus Being

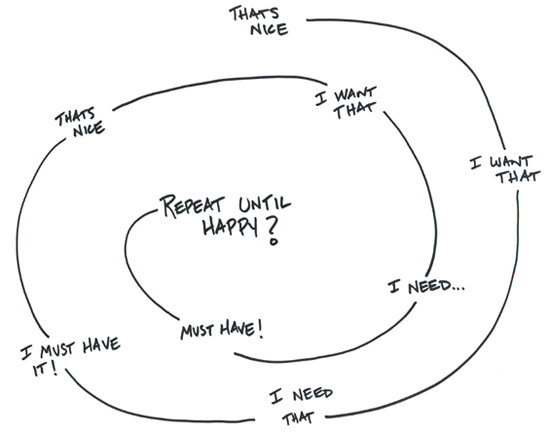

Do you confuse your needs with your wants? Have you caught yourself thinking that you “need a vacation” or “need to try a pumpkin latte”? If yes, your sense of entitlement may be making you lose sight of what you really need versus what you want. So, where does a sense of entitlement come from? […]

Are You Even on the Road to Retirement?

When you are decades away from retirement, it is hard to make retirement saving your #1 financial goal. However, it is likely your largest financial goal and you need to know whether or not you are on track. Here is what you need to know to make sure you are on the right path to retirement.

Look Out! Year of the Dragon

Financial advice for the Year of the Dragon.

Three Cheers for Year of the Rabbit

For most clients that I worked with over the past year, 2010 has been a turbulent year full of both highs (new babies, new jobs) and lows (home value declines, pay cuts). And if you follow the Chinese Zodiac calendar, this is not surprising since it was the Year of the Tiger. The Year of […]

Extend Thanksgiving & Save Money

Are you one of the 152 million people expecting to shop this weekend? This number is up 10% over last year and sales are expected to rise 2%. Everything I read about the economy revolves around high unemployment and low consumer confidence. So, how is this possible? Is it habit, boredom, or not wanting to […]

Driving Costs Driving You Crazy?

When you think of how you want to spend your hard earned money, rarely do you think “I want to overpay for car insurance and spend $70 to fill up my tank!” Car related expenses are a necessity for most families, but there are easy ways to reduce these costs and make sure you are […]