Food Inflation

In 2018, the average family of four in the Bay Area spent $1,200 – 1,600 per month on groceries. In 2022, the average has increased by over 25% to $1,6002,000 per month. Food tends to be one of the top three areas of spending for families after Home and Childcare. How much do you spend? […]

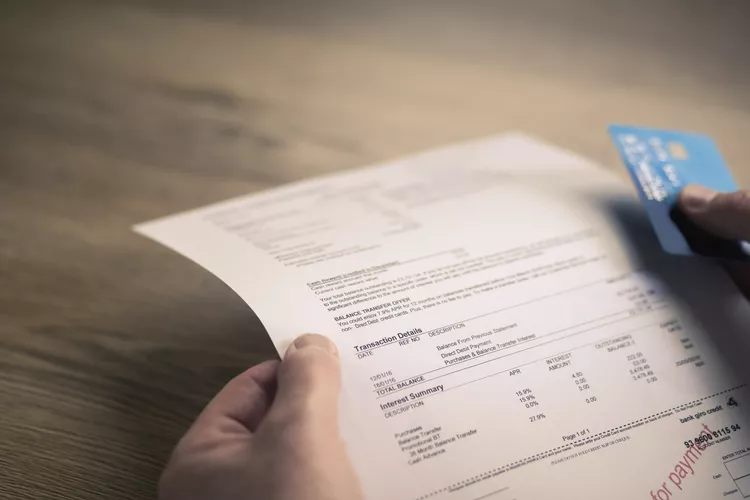

The Monthly Credit Card Bill

For the last few years, I have noticed the creep of my client’s and my own credit card bill balances. Ten years ago, a bill over $8,000 was an outlier. It meant you bought a hot water heater or paid for a week in Hawaii. Nowadays, a bill under $8,000 is a good month. Two […]

Time to Panic

Equity sector relative performance has tended to be differentiated across business cycle phases. Unshaded (white) portions above suggest no clear pattern of over- or underperformance vs. broader market. Double +/– signs indicate that the sector is showing a consistent signal across all three metrics: full-phase average performance, median monthly difference, and cycle hit rate. A […]

Micro Financial Planning

I help my clients plan for the next 1-5 years. This was considered “short-term” planning in the world of personal finance. However, there is so much uncertainty in the world right now that planning for the future seems like an exercise in fantasy. Think back to a year ago… did you think 2020 would turn […]

The Election & the Market

I wanted to pass on some interesting information regarding the Election & the Market that I gleaned from a Ned Davis Research webinar on the topic today. Just like 2016, most people are freaking out about who might win. I get emails all time asking whether folks should sell or stay put in their investments […]

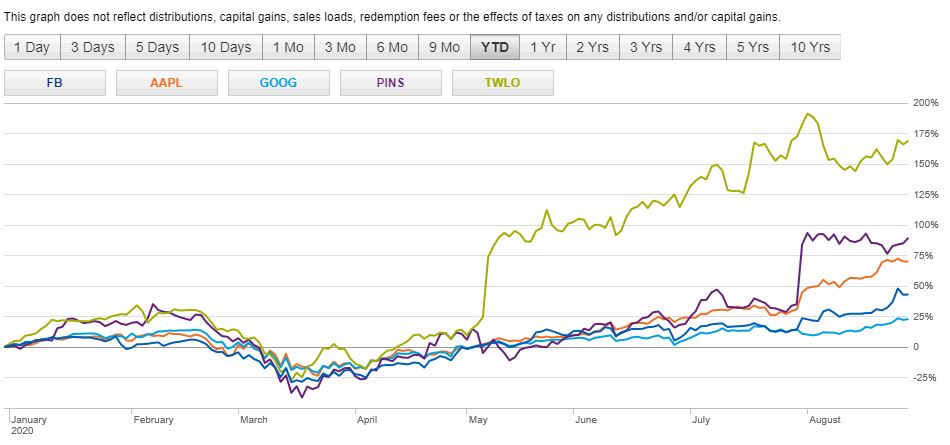

Time to Sell?

My dad always tells me “Trees can’t grow to the sky.” But look at this picture. Despite a continued global pandemic, economic contraction and millions unemployed, the stock market keeps on going. Many of the companies for which my clients work has seen their equity values continue to increase since March 2020. Can this rise […]

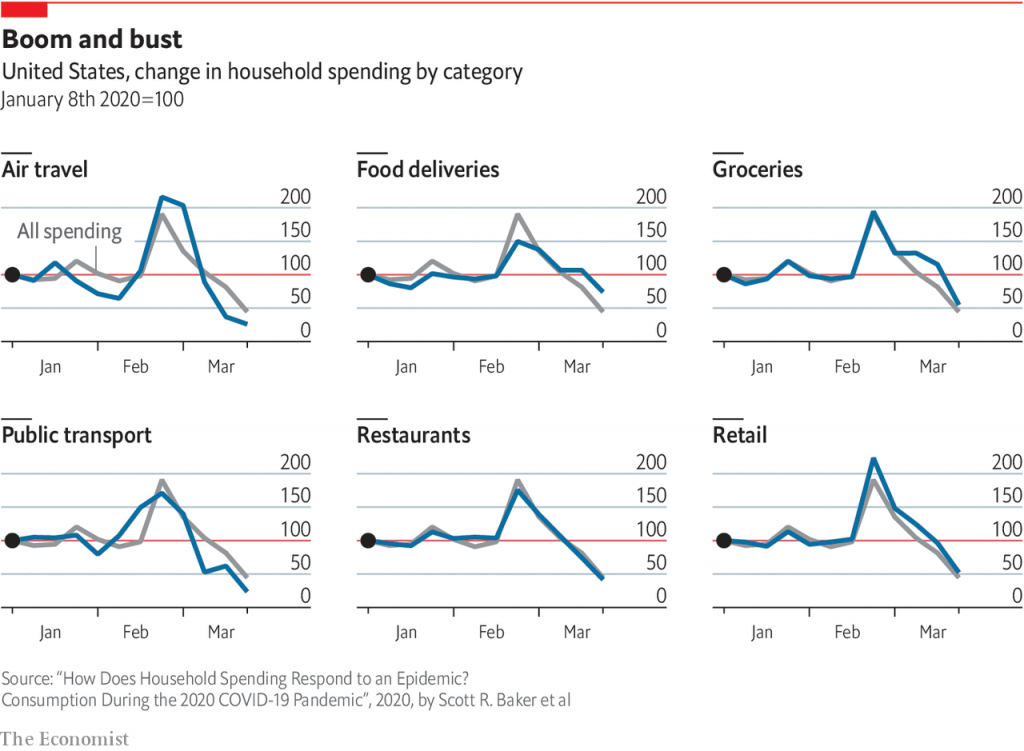

SPENDING IN A PANDEMIC

After a little light reading of “How Does Household Spending Respond to an Epidemic? Consumption During the 2020 COVID-19 Pandemic” from the National Bureau of Economic Affairs, I wanted to share with you some tidbits I found interesting. In late February until mid-March, stores were mobbed with long lines of people stockpiling groceries and other […]

Build Your Financial House

I have no idea where the phrase “getting your financial house in order” comes from. A quick Google search resulted in nothing useful. I guess the idiom makes sense since a house starts with blue print (plan) and is comprised of rooms that have purpose like a kitchen, bathroom and bedrooms (specific accounts or areas […]

Year of the Rat & Your Money

Say goodbye to the Year of the Pig, and hello to the Year of the Rat, the first year of the 12-year Chinese Zodiac cycle. Last year, the Pig was supposed to symbolize wealth and generosity, and be a calming force in world events. Hmmm, not so sure that manifested. The Rat is all about […]

When is Enough Enough?

In a culture of work and spend, there can be an endless search for more. However, research shows that money only affects emotional well-being or happiness up to an annual income of ∼$210,000 per family, or ~$275,000 when adjusted for the cost of living in the Bay Area. Too much money can actually have a negative […]