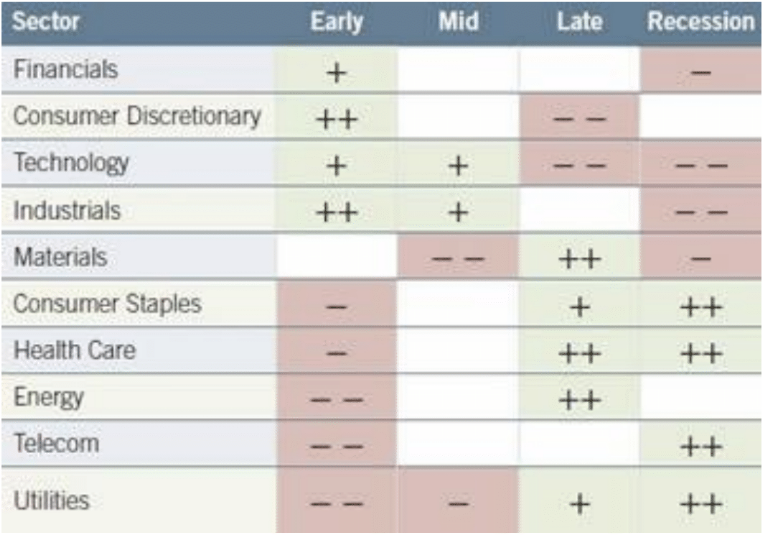

Equity sector relative performance has tended to be differentiated across business cycle phases.

Unshaded (white) portions above suggest no clear pattern of over- or underperformance vs. broader market. Double +/– signs indicate that the sector is showing a consistent signal across all three metrics: full-phase average performance, median monthly difference, and cycle hit rate. A single +/– indicates a mixed or less consistent signal. Source: Fidelity Investments (AART).

http://finandlife.com/post/2014/10/12/How-to-invest-using-the-business-cycle.aspx

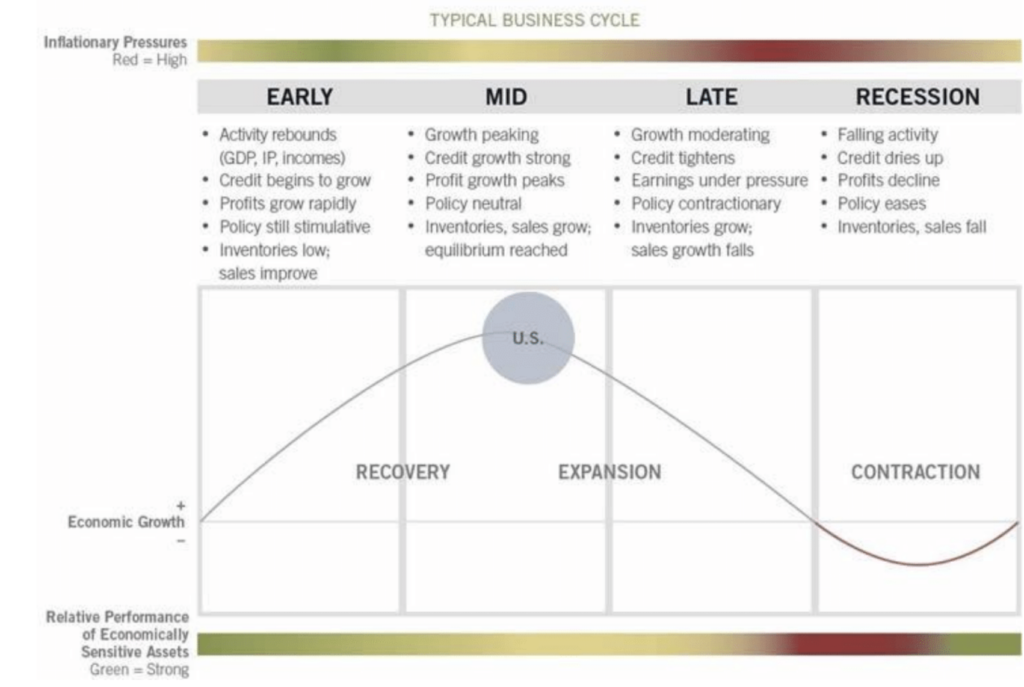

Fluctuations in the business cycle are essentially distinct changes in the rate of growth in economic activity, particularly changes in three key cycles—the corporate profit cycle, the credit cycle, and the inventory cycle—as well as changes in the employment backdrop and monetary policy.