Time to Sell?

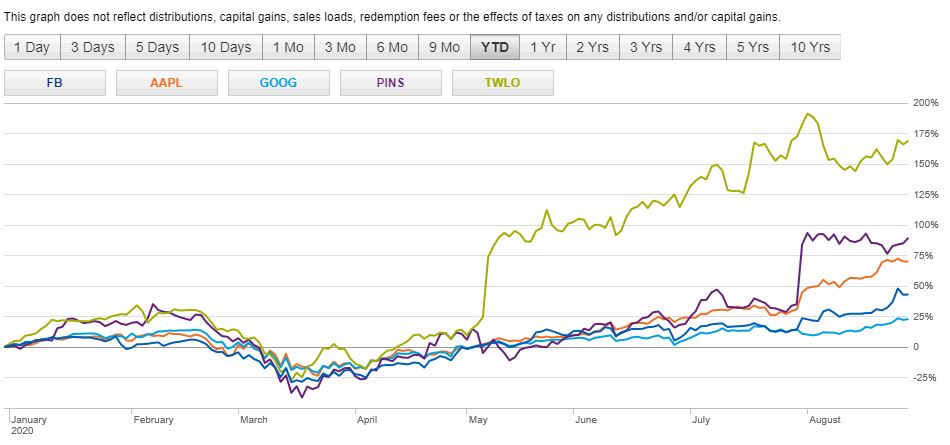

My dad always tells me “Trees can’t grow to the sky.” But look at this picture. Despite a continued global pandemic, economic contraction and millions unemployed, the stock market keeps on going. Many of the companies for which my clients work has seen their equity values continue to increase since March 2020. Can this rise […]

Up, Up and Away

I first starting working with Dan and Robin back in October 2012 when they were in their early thirties, newly married and just starting their lives together. At the time, they were earning around $230,000 per year and were never big spenders. Their monthly outflow was around $5,600 per month, which adjusted for inflation today […]

45… The Tipping Point to Becoming Debt Free

I turned 45 during confinement. Including a two year break from the workforce for business school, I have been working 20 years. So, I’m halfway through my working years based on retiring at 65. It’s a cliché, but I like what I do and don’t have a desired target retirement date in mind. That said, […]

PAYING FOR THE UNEXPECTED

Every year something unexpected comes up. Sometimes it is fun stuff, but usually it’s a broken windshield, root canal or something even more unforeseen. Last summer, I booked us a trip to the Canary Islands for February break. Tickets were affordable, and I was told by my friends in Europe that it was like their […]

Optimize Your Employee Benefits

For a lot of working people, open enrollment is approaching (October through November). This usually means boring emails from your HR department and having to make a bunch of decisions to make that you may not be sure about. According to the Department of Labor, benefits through work account for 31.8% of the cost of […]

How to Teach Your Children that Money Doesn’t Buy Happiness

My son is seven years old and thinks it is super cool to pretend to “make it rain” with his hands and imitate stacks of money flying in the air. My first reaction is to cringe and wish he didn’t think it was cool. Sometimes I hear him say things like, “If I had a […]

What’s the point of Money?

One of my favorite financial planners recently wrote in the New York Times, “The point of money is to help make and keep you happy and fulfill the hopes and dreams that align with your own (often irrational and emotional) values.” To me, this statement is the very essence of financial planning. Personal financial planning […]

Top Five Money Lessons for Kids

In general, talking about money makes people tense. So, how can you talk to our children openly and effectively about money? Money is its own language, and as parents you have the opportunity to create a plan to educate your kids and make money skills a priority. To help you, here is a list of […]

Kids Savings Account- Do they need one?

No, children do not need a savings account but most parents feel like they should open one up as soon as their child gets their first birthday or holiday check. Most of the time, these account balances hover around the same amount of money for years and the bank pays very little interest (like 0.01%). […]