July Tax Changes

Here’s a breakdown of how the SALT deduction (State and Local Tax) works under the One Big Beautiful Bill Act (OBBBA) for high-income earners, specifically married couples earning more than $250,000.

The SALT deduction lets taxpayers deduct state and local taxes paid (such as:

- State income taxes

- Property taxes

- Sales taxes (in some cases)

from their federal taxable income—only if they itemize deductions. A lot of filers who switched to the standard deduction in 2018 may go back to itemizing this year.

The Old Rule (2018-2024) capped the deduction at $10,000 for all taxpayers, regardless of income. This was a major issue for residents in high-tax states (e.g., CA, NY, NJ).

The New Rule (2025-2028) cap is temporarily increased to $40,000 for married couples filing jointly with income under $500,000. BUT: A phase-out applies once MAGI exceeds that threshold. Once you make $600,000+, you go back to only claiming $10,000 for SALT deductions.

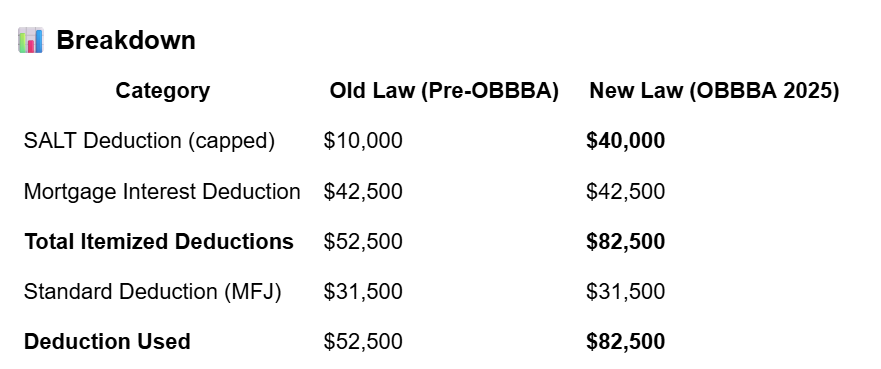

A married couple earning $400,000 in California, paying $25,000 in property taxes and holding a $1 million mortgage at 4.25%, would benefit as follows under the new tax law:

Tax Savings

- Additional deduction: $30,000

- At a 32% marginal tax rate, that equals:

- ✅ $9,600 in federal tax savings

We all want to pay less taxes. If you haven’t updated your financial plan in the last year or keep meaning to get started on creating a financial plan, now is a great time. Here is a link to schedule a Financial Update (for existing clients only) or a free consultation (for new clients only).