Micro Financial Planning

I help my clients plan for the next 1-5 years. This was considered “short-term” planning in the world of personal finance. However, there is so much uncertainty in the world right now that planning for the future seems like an exercise in fantasy. Think back to a year ago… did you think 2020 would turn […]

Time to Refi?

Rates are at lows that I have never seen. The US weekly average rates were 2.71% for a 30 year fixed and 2.26% for a 15 year fixed for the week of 12/10/20. Over the last ten years, you can see on the chart below that these rates are rock bottom for fixed rate loans. […]

The Big Win- A Client Story

Christina and Tom are like many couples. They worked hard, built careers, had a baby, saved money and kept thinking about buying a house. Pre-Covid, they had already decided that they were pretty sure they wanted to move to the Boston area to be closer to family and be able to afford a nicer home. […]

Time to Sell?

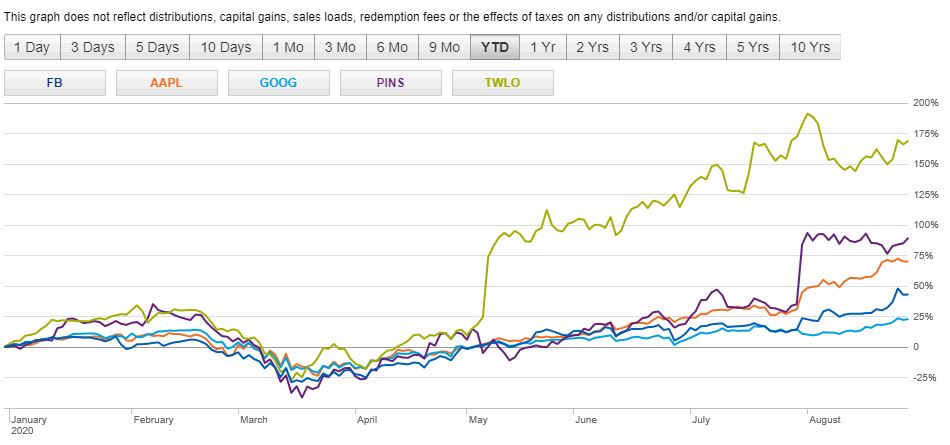

My dad always tells me “Trees can’t grow to the sky.” But look at this picture. Despite a continued global pandemic, economic contraction and millions unemployed, the stock market keeps on going. Many of the companies for which my clients work has seen their equity values continue to increase since March 2020. Can this rise […]

Build Your Financial House

I have no idea where the phrase “getting your financial house in order” comes from. A quick Google search resulted in nothing useful. I guess the idiom makes sense since a house starts with blue print (plan) and is comprised of rooms that have purpose like a kitchen, bathroom and bedrooms (specific accounts or areas […]

Magic of Money

I’ve noticed a trend in the last year that makes me think there is something magical happening. The trend is towards greater responsibility for one’s financial destiny. My newer clients aren’t playing the victim card of living in an expensive area. Instead, they are making decisions to lower spending and setting savings goals, which they […]

The Diligent Squirrels

It’s been seven years since I first met the Squirrel family, who live in San Francisco, have three children, aspirations of the best education for those children and a strong desire to be homeowners. With all of these goals, they seem to make the improbable possible. A family needs to make more than $250,000 per […]

THE COST OF COMMUTING

Unless you land a 100% virtual job, most people have some commute to work. If you live in a major metropolitan area, you can either live in the city and paying more for housing or move out of the city to hopefully save on the cost of housing and get some extra space. While urban […]

YEAR OF THE EARTH DOG 2018- HOW TO MANAGE YOUR FINANCES

We have had two straight years of craziness with the year of the Monkey followed by the year of the Rooster. The Rooster symbolized the need to be heard, as well as egoism, despotism and belligerence. The impulsiveness and emotional instability of the Rooster meant that taking action without thinking won out! February 16, 2018, […]