Is the freedom that money buys worth the sacrifices you make to reach this freedom?

“What is important in life is life, and not the result of life.” ~ Johann Wolfgang Von Goethe

Setting financial goals and creating your financial plan is all about determining your destination. And if life is about the journey, not the destination, then sacrificing today for tomorrow is a big contradiction. So, how can you live the journey you want and still reach your financial goals?

Step 1: Clarify your family’s goals first (financial and non-financial). For example: have six months’ worth of expenses in cash at all time as an Emergency Fund, travel as a family twice per year, be present and grow as a person each day, contribute to society, and retire by age 60.

Step 2: Determine your family’s values. What is most important to you? Based on the example above, the values could be financial security, personal growth and presence.

Step 3: Align your goals with your values to get your priorities. The list may be long, so pick your top three and focus on those. Based on the goals and values above, you could determine your top three priorities as: maximize pre-tax retirement savings each year, budget for two family trips per year and build/maintain Emergency Fund.

Step 4: Use your resources to achieve those goals. Look at your family’s balance sheet and make sure every dollar has a purpose. For example, if you have a lot of money sitting in your checking account earning no interest, determine what you really need in your checking account and put the rest into a high yield savings account and call it your Emergency Fund.

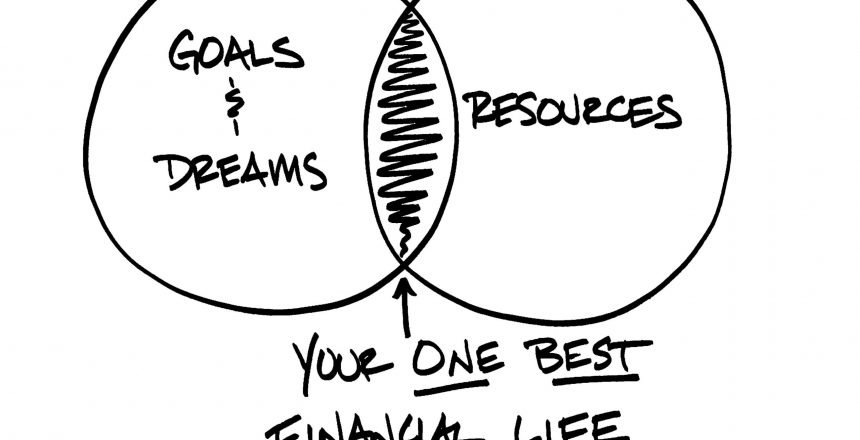

Carl Richards wrote a great book called “The Behavior Gap”. He simplifies complicated financial topics into easy to understand drawings. This is one of my favorites, titled “One Best Financial Life.”

If you define your own pursuit of financial freedom, the journey can be liberating. Do not let society, a family member or financial advisor dictate what is most important to you. As a financial planner, I am a big advocate of planning but it is the process of planning and journey that make the plan itself meaningful.

Katy Song, CFP, focuses on comprehensive financial planning for families with young children and couples starting their lives together. You can contact Katy at katy@katysong.com , visit her website katysong.com, or follow her on twitter @katydavissong. She lives in Mill Valley with her husband, 5 year old daughter and 1 ½ year old son.