How to Spend Less this Summer

By summertime, the financial stress of tax time is most likely a distant memory. Summertime usually means vacation, time off from work, and more opportunities for overall discretionary spending. As a financial planner trying to help some of my clients curb the urge to spend on “frivolous” stuff, this time of year can make me […]

Top 5 Financial Moves for 2013

With uncertain economic times, here are the Top 5 Financial Moves for 2013. Make these financial moves and improve your family’s financial future now.

Slow and Steady Wins the Race- The Year of the Snake

The Year of the Snake is a big departure from the Year of the Dragon when it comes to finances. Make the best of this year by following my advice.

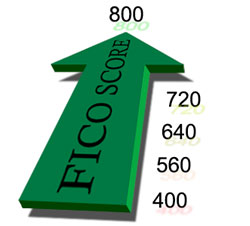

Optimize Your Credit Score

Learn how to optimize your credit score and save a bundle of money over your lifetime.

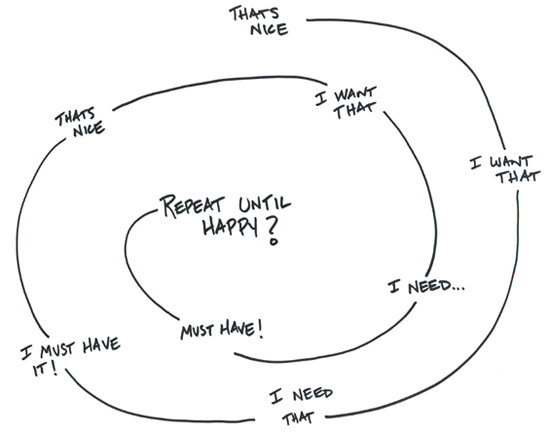

Having versus Being

Do you confuse your needs with your wants? Have you caught yourself thinking that you “need a vacation” or “need to try a pumpkin latte”? If yes, your sense of entitlement may be making you lose sight of what you really need versus what you want. So, where does a sense of entitlement come from? […]

Can Money Buy Happiness?

Can Money Buy Happiness In the last fifteen years, positive psychology has tried to tackle the question of “can money buy happiness” by studying people’s happiness levels along with changes in income levels. Also known as the “hedonic treadmill” theory, studies show that once your basic needs are met (clothing, shelter, food) that rich people […]

Back to School- Money 101 for Parents

It’s back-to-school time! Take this four month Money 101 for Parents challenge and make the rest of this year count.

Investing in Uncertainty

Three simple steps to help you invest in uncertain times.

Inheritance- The Taboo Topic

As part of my client’s financial planning process, we discuss retirement and even the taboo topic of inheritance. There are three camps that most families with young children fall into: 1) They think they’ll get something, 2) Their parents are set with pensions and savings but there will not be anything left over for inheritance, […]

Don’t Miss the Journey to Financial Freedom

Is the freedom that money buys worth the sacrifices you make to reach this freedom? “What is important in life is life, and not the result of life.” ~ Johann Wolfgang Von Goethe Setting financial goals and creating your financial plan is all about determining your destination. And if life is about the journey, not […]