Having versus Being

Having versus Being Do you confuse your needs with your wants? Have you caught yourself thinking that you “need a vacation” or “need to try a pumpkin latte”? If yes, your sense of entitlement may be making you lose sight of what you really need versus what you want. So, where does a sense of […]

Credit Cards: Friend or Foe

With today’s perks, credit cards can help you earn free flights, hotel stays, gift cards and give you actual cash back. The average cardholder has 3.7 cards in their wallet and carries a balance of over $4,800. Racking up credit card debt can be like putting on holiday pounds; it is quick and can be […]

Take A Paid Vacation

For most homeowner’s in the Bay Area, your home is your largest asset. The great thing about owning a home from a financial perspective is that it is an appreciating asset (goes up in value over time) from which you get utility (you get to live in it!), and you get a tax benefit from […]

Slash & Burn: A Fresh Start for Your Finances

In elementary school I remember learning about the farming technique “slash & burn” where farmers burned their crops to the ground in order to fertilize the soil and get the land ready for the next crop. The farmers did this because the soil was exhausted and needed to be replenished. This same technique can be […]

Keeping Up With the Joneses

One of the most common things that couples say to me is, “We make a good living but don’t have nearly enough to show for it at the end of the year.” Sometimes it is worse, and the family has accumulated credit card debt to keep afloat. The culprit is not knowing cash inflows and […]

How much is Mom Worth?

Being a mom is one of the hardest (if not THE hardest) job. While it is a rewarding pursuit to create good little citizens that will hopefully make the world a better place, it is nearly impossible to take “time off” from being a mom and working overtime is part of the job. Due to […]

Time To Buy A New Car

I bought my last car a year after finishing business school and pre-kids. I bought an Audi Allroad (which my boss at the time called a “grocery-getter”), and it served me well through a few ski leases in Tahoe, two babies and a dog. Last year I was faced with a big car repair bill […]

Back to Basics & Harmony – The Year of the Sheep (Goat)

The wild ride from the Year of the Horse is almost over. Last year was a very busy year, full of high energy, self-improvement and unexpected adventure. In contrast, the mood of the Year of the Sheep is all about peace, tranquility and harmony. Although tension and volatility continue in the global economy, the Year […]

Tax Season – Time to Trim the Financial Fat

It is everyone’s favorite season… tax time! Breaking even on taxes is like seeing a Jack-a-lope. It does not happen (at least to my knowledge). If you are getting a refund, it means that you over paid your taxes throughout the year and lent the government money with no return. Not the best investment to […]

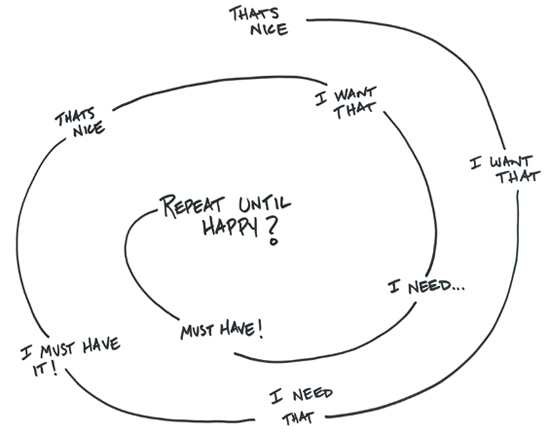

The Do Nothing Financial Plan

One of my favorite financial planners, Carl Richards, drew this sketch on the left. This image sums up a lot of initial conversations that I have with clients. I am fortunate to work with well-educated and motivated couples. There seem to be two main reasons why very smart people do nothing about their finances: 1) […]