Smart Frugality

With the holidays approaching and spending about to ramp up, at least for most people, there are ways for you to reign in holiday expenses and save some big money. With Craigslist, eBay, Nextdoor, and innumerable online consignment sites, you do not have to sacrifice quality to save money. I do not like to spend […]

Credit Cards: Friend or Foe

With today’s perks, credit cards can help you earn free flights, hotel stays, gift cards and give you actual cash back. The average cardholder has 3.7 cards in their wallet and carries a balance of over $4,800. Racking up credit card debt can be like putting on holiday pounds; it is quick and can be […]

Take A Paid Vacation

For most homeowner’s in the Bay Area, your home is your largest asset. The great thing about owning a home from a financial perspective is that it is an appreciating asset (goes up in value over time) from which you get utility (you get to live in it!), and you get a tax benefit from […]

The $35 Spin Class

It sounds ridiculous to pay $35 for a 45 minute spin class, right? It is hard to financial justify spending this kind of money when I can go for a bike ride for free. However, does this expense pass my Index Card Test? What is an Index Card Test? In my purse I carry an […]

Surviving the Cost of Kids

It is hard to save money when you have kids. So how can you survive and save while your children are young? Here are my Top Four Action Items to get you saving during the cash crunch years of early childhood.

Slow and Steady Wins the Race- The Year of the Snake

The Year of the Snake is a big departure from the Year of the Dragon when it comes to finances. Make the best of this year by following my advice.

Back to School- Money 101 for Parents

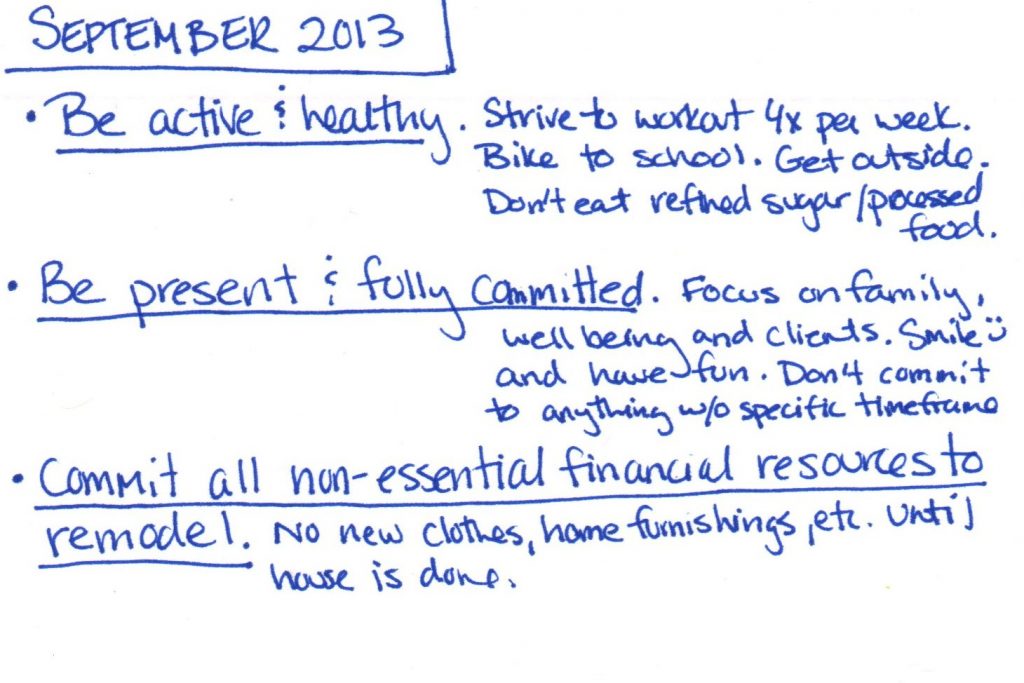

It’s back-to-school time! Take this four month Money 101 for Parents challenge and make the rest of this year count.