Exciting news! I am now the Chief Financial Planner of Domain Money. It’s the same great expert financial planning with no strings attached. And now, I have a small army of Katy’s to help more people!

Financial planning is for everyone –

not just the very wealthy.

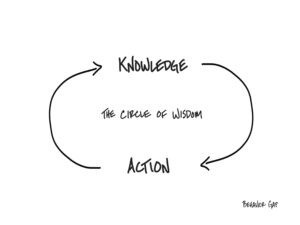

Everyone has financial goals. The hard part can be setting those goals and creating a roadmap to attain them. Financial planning provides the starting point and the process to adapt and achieve what matters to you most.

Financial Planning Services

Global

Financial Plan

Comprehensive

Financial Plan

Strategic

Financial Plan

One Page

Financial Plan

Financial

Alignment

Ongoing

Coaching

Subscribe to my newsletter below to receive

Top 7 Financial Tips for Parents

Subscribe to my newsletter below to receive

Top 10 Financial Tips for COUPLES

Who I Am

Raised in Rye, New York, I moved to California in 1993 to attend the University of California, Santa Cruz (Go Banana Slugs!). After graduating in 1997 with a B.A. in Global Economics, honors in my major and Phi Beta Kappa, I worked for the U.S. Department of Commerce in the International Trade Administration. I then attended the Haas School of Business at the University of California, Berkeley and graduated in 2002. I worked as an investment banker for Citigroup until having my daughter in 2007…

Latest from the blog

“Most Terrifying Experience of My Life”

by Matthew Boyle, Katy Song Financial Planning Summer Intern 2023 It happened in the early morning. My dad got up with what he thought was

Is it time to buy an EV?

Tesla, Tesla, Tesla, Rivian, etc… Electric cars seem to be everywhere now. Many families are considering electric cars (EVs) because they are better for the

What do you want?

I just read Luke Burgis’ “Wanting”, which is excellent (and a little heavy), and I wanted to share with you some ideas to think about