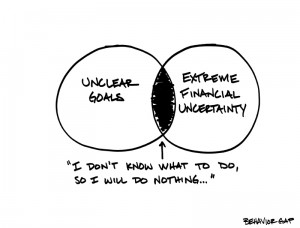

One of my favorite financial planners, Carl Richards, drew this sketch on the left. This image sums up a lot of initial conversations that I have with clients. I am fortunate to work with well-educated and motivated couples. There seem to be two main reasons why very smart people do nothing about their finances: 1) fear of bad news and 2) they do not know “exactly” what to do.

One of my favorite financial planners, Carl Richards, drew this sketch on the left. This image sums up a lot of initial conversations that I have with clients. I am fortunate to work with well-educated and motivated couples. There seem to be two main reasons why very smart people do nothing about their finances: 1) fear of bad news and 2) they do not know “exactly” what to do.

My advice: Make room for uncertainty and learn to adapt. Think about where you were ten years ago. Did you picture yourself with your current job, house and daily life?

Life’s waters are murky. You need to plan the best you can given your current circumstances and give yourself room to adapt to changes.

If you do not have a financial plan in place for your family, start one now. Yes, right now.

Step 1: Make a list of financial goals that are important to you and the approximate timing of those goals. They can be big goals and small goals. Here are my top four: retirement (2035), college for two kids (2025, 2029), trip to Korea/Japan (spring 2016), and pay off car loan three years early (end of 2016).

Step 2: Determine a price tag for each goal. This may take some online research or getting bids from contractors (if you want to do home improvement), so do one goal at a time. Sticking with my list above, here are the price tags to my goals:

Retirement (2035). Given current savings levels, we need to save $18,000 per year. This has always been a priority for me and my husband, so we are in a good place. Tip: Try Schwab’s Retirement Calculator. Retirement calculators can get complicated, so keep it simple for this exercise. MarketWatch.com also has a good calculator with more ways to customize your retirement calculations.

College for two kids (2025, 2029). For private college, $35,000 per year savings required, and for a UC $15,000 per year. While we would like our kids to go to the best school for them, we save $15,000 per year for now. This will go up in 2016 when we no longer have to pay for pre-school (hooray!).

Tip: Try SavingforCollege.com’s World’s Simplest College Calculator. It comes with pretty charts and graphs too.

Trip to Korea/Japan (spring 2016). Airfare ~$3,600, lodging $3,000, food $2,100, and other $500 = $9,200.

Pay off car loan (end of 2016). I need to increase my monthly payment by $450 to $800 per month to have the loan paid off in two years (instead of five).

Step 3: Set up automated payments for these goals or give yourself wiggle room to make adjustments. For retirement, my husband maximizes his 401(k). For college, we put holiday and birthday money from grandparents into 529 Plans, and I hire my kids and pay them a salary each year, which goes into Roth IRAs. For travel, we set up an automatic savings plan to Capital One 360 from our checking account of $750 per month. Pre-paying the car loan will wait until I see how we are doing at year-end.

Sit down mid-year and year-end (or before holidays would be better) and see if you need to make any adjustments. While paying off my car loan early would be nice, the other goals are more important. I am going to wait until I have funded the vacation to Korea before accelerating payment on my car loan.

That is a plan.