Do you want to work from home? Do you want more flexible work hours? Do you need to make some extra money to afford your desired lifestyle? Maybe it is time to join the Freelance Economy.

In almost every industry, freelancing has become popular for professionals looking to take more control over their hours and work experiences. For those tired of the office grind, wasted face time hours, or death by conference calls, the freedom of freelancing is very appealing.

As soon as you start a family parents have two jobs: provider and caregiver. Freelancing can be a dream job for moms (and dads) as it gives you the ability to make a living and spend a lot of time with your kids. There are approximately 53 million freelancers in the U. S., which makes up 34% of the workforce.

How much do freelancers make?

A recent Money magazine poll indicates that 78% of people polled would freelance if they knew they could make enough money. For Gen X women, 23% (versus 10% of Gen X men) say needing time with kids is a primary driver of their choice to freelance.

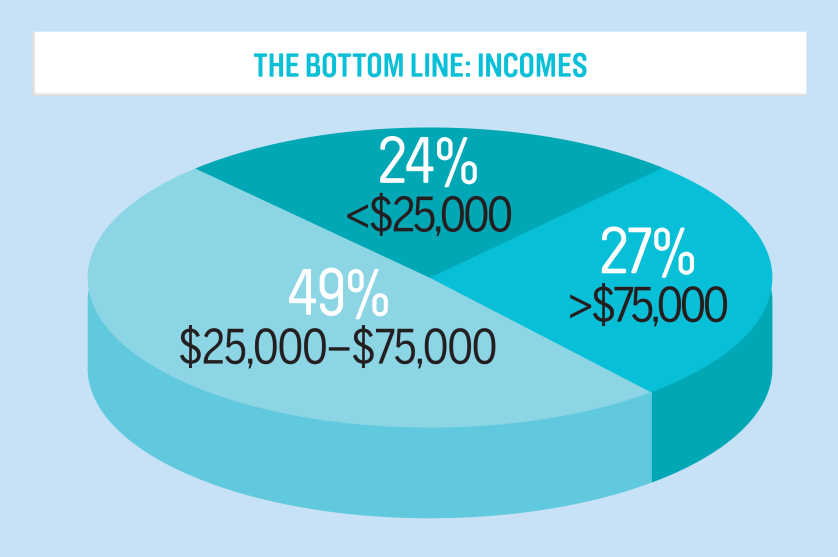

The majority of freelancers make over $25,000 per year. For a 15 hour work week, that equates to $32 per hour. This is a global average. The number of freelancers making over $100,000 per year has increased 45% to 2.9 million in 2015.

The majority of freelancers make over $25,000 per year. For a 15 hour work week, that equates to $32 per hour. This is a global average. The number of freelancers making over $100,000 per year has increased 45% to 2.9 million in 2015.

How much should you charge?

Figuring out your value and what to charge clients can be daunting. One approach is to take what you would be making as an annual salary doing in-house work ÷ 52 weeks ÷ 40 hours × 2.5 (for overhead) = Freelance hourly rate. For example, if you would make $100,000 full-time in-house you should charge $120 per hour.

In the freelance economy, there also seems to be much less gender income inequity. Women tend to make 97% of what men make freelancing versus 78% in the general workforce.

Other benefits of freelancing?

Besides more control over your hours, work experience and earnings, there are several tax benefits of freelancing. Tax deductions include health and business insurance, cell phone, education courses to help you progress in your field, as well as a pro-rata portion of home office rent/mortgage, property taxes, and utilities. One of the biggest benefits can be retirement savings. As a self-employed person, you can save 25% of your net business income (revenue minus expenses) up to $53,000 per year (2015) into a Simplified Employee Pension (SEP) IRA. This can mean big savings during tax time.

In the first year of freelancing, you may not make enough money to offset your “expenses”. Don’t worry. You can carry these losses forward to offset your income the next year.

Where can you find a freelance job?

There are a ton of websites that provide easy to use platforms to outsource jobs and find ones that fit your skills. Some of the top sites are Upwork, Toptal, Peopleperhour, and Freelancer.

For tips to make a freelance lifestyle work for you, check out freelancemom.com.

While going out on your own can be a scary endeavor, I have yet to meet anyone who regretted their decision to be independent and didn’t end up making more money than they ever thought they would. As President Jimmy Carter once said, “Go out on a limb. That’s where the fruit is.”