What do you want?

I just read Luke Burgis’ “Wanting”, which is excellent (and a little heavy), and I wanted to share with you some ideas to think about before you buy your next anything. He classifies desires (or wants) into two distinct categories: Think and Thin. Thick desires are those that you can explain why you want them. […]

Are You Addicted to Amazon

One-click shopping. Prime delivery. Millions of products. Is there anything not to love about Amazon? But with this easy customer experience and vast selection, it can be tempting to make purchases on Amazon daily. And those purchases can seriously add up, especially for families. A 2019 survey showed a family using Amazon Prime will spend […]

Food Inflation

In 2018, the average family of four in the Bay Area spent $1,200 – 1,600 per month on groceries. In 2022, the average has increased by over 25% to $1,6002,000 per month. Food tends to be one of the top three areas of spending for families after Home and Childcare. How much do you spend? […]

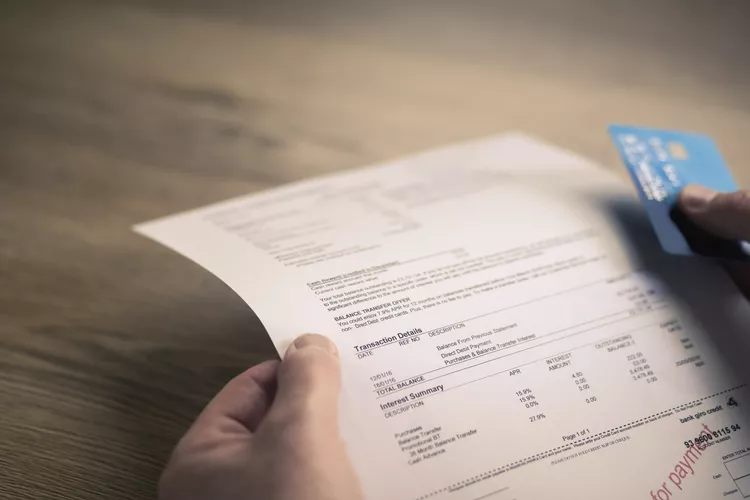

The Monthly Credit Card Bill

For the last few years, I have noticed the creep of my client’s and my own credit card bill balances. Ten years ago, a bill over $8,000 was an outlier. It meant you bought a hot water heater or paid for a week in Hawaii. Nowadays, a bill under $8,000 is a good month. Two […]

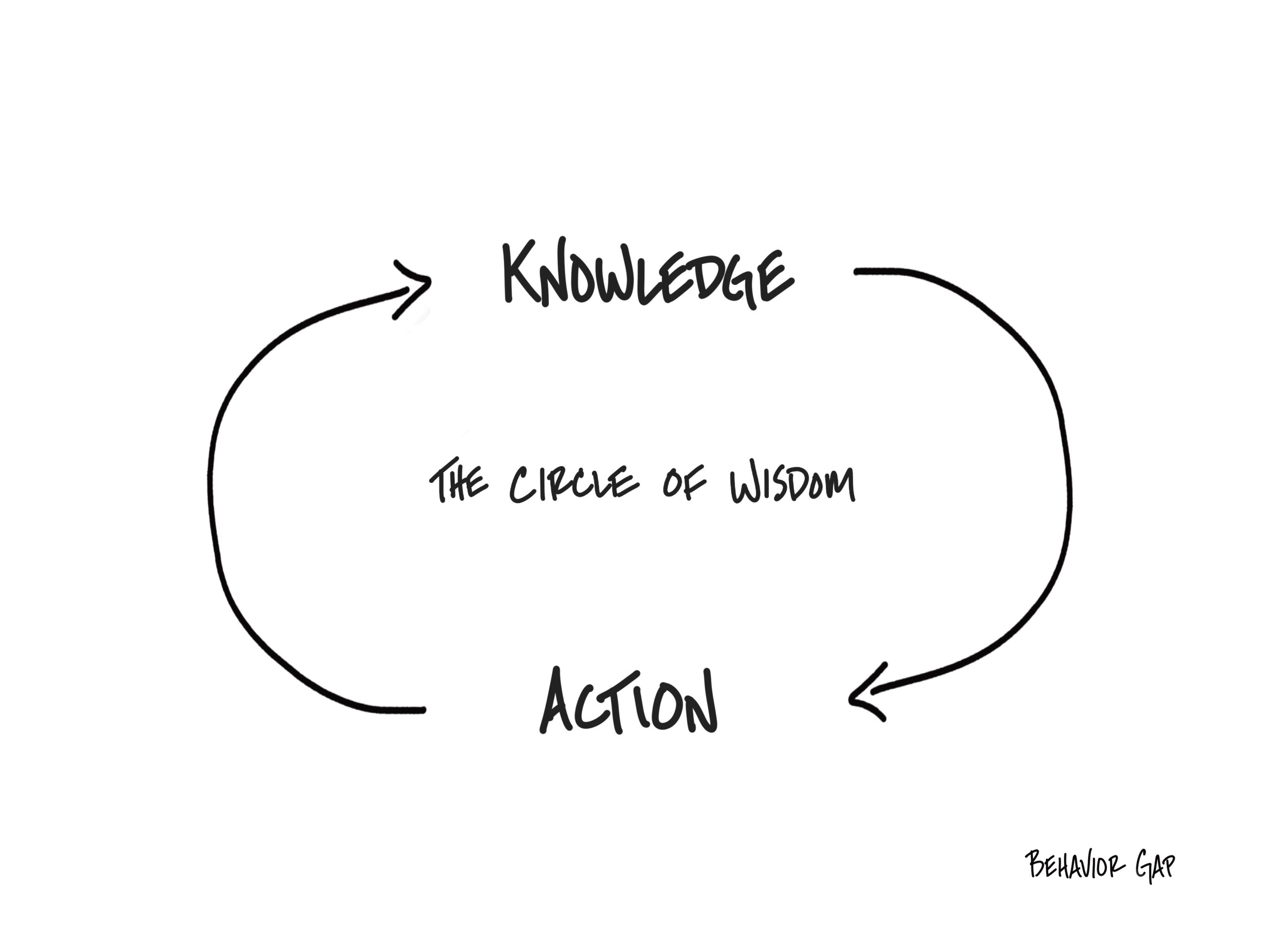

Micro Financial Planning

I help my clients plan for the next 1-5 years. This was considered “short-term” planning in the world of personal finance. However, there is so much uncertainty in the world right now that planning for the future seems like an exercise in fantasy. Think back to a year ago… did you think 2020 would turn […]

Time to Refi?

Rates are at lows that I have never seen. The US weekly average rates were 2.71% for a 30 year fixed and 2.26% for a 15 year fixed for the week of 12/10/20. Over the last ten years, you can see on the chart below that these rates are rock bottom for fixed rate loans. […]

Up, Up and Away

I first starting working with Dan and Robin back in October 2012 when they were in their early thirties, newly married and just starting their lives together. At the time, they were earning around $230,000 per year and were never big spenders. Their monthly outflow was around $5,600 per month, which adjusted for inflation today […]

45… The Tipping Point to Becoming Debt Free

I turned 45 during confinement. Including a two year break from the workforce for business school, I have been working 20 years. So, I’m halfway through my working years based on retiring at 65. It’s a cliché, but I like what I do and don’t have a desired target retirement date in mind. That said, […]

HOW MUCH IS YOUR HEALTH WORTH?

Health insurance, co-pays, out-of-network, out-of-pocket, OT, PT, etc. are significant costs for a family. Add to those costs a gym membership, fitness classes and mental health costs and you’re talking a couple of thousand dollars a month. This is doable when you are employed and have a steady paycheck coming in, but Covid-19 has shown […]

PAYING FOR THE UNEXPECTED

Every year something unexpected comes up. Sometimes it is fun stuff, but usually it’s a broken windshield, root canal or something even more unforeseen. Last summer, I booked us a trip to the Canary Islands for February break. Tickets were affordable, and I was told by my friends in Europe that it was like their […]