Money Management On The Go

The #1 issue facing families with young children that live in the Bay Area is managing cash flow. The most common story is a couple, making very good money, get married and buy a house based on their DINK income levels (“dual income no kids”). Then, baby #1 arrives. Things get a little tighter financially […]

Money Management On The Go

The #1 issue facing families with young children that live in the Bay Area is managing cash flow. The most common story is a couple, making very good money, get married and buy a house based on their DINK income levels (“dual income no kids”). Then, baby #1 arrives. Things get a little tighter financially […]

Surviving the Cost of Kids

It is hard to save money when you have kids. The cost of full-time childcare so that both parents can work is astronomical. Adding to those fixed costs are all the extra expenses like activities, camp, baby supplies, toys, birthday parties and even an extra seat on the airplane while travelling. Having kids is expensive! […]

Having versus Being

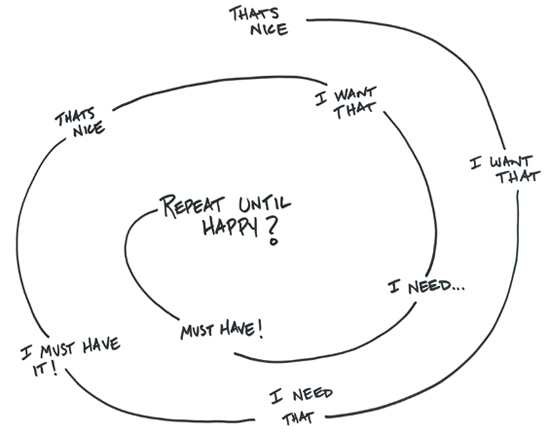

Having versus Being Do you confuse your needs with your wants? Have you caught yourself thinking that you “need a vacation” or “need to try a pumpkin latte”? If yes, your sense of entitlement may be making you lose sight of what you really need versus what you want. So, where does a sense of […]

Credit Cards: Friend or Foe

With today’s perks, credit cards can help you earn free flights, hotel stays, gift cards and give you actual cash back. The average cardholder has 3.7 cards in their wallet and carries a balance of over $4,800. Racking up credit card debt can be like putting on holiday pounds; it is quick and can be […]

Take A Paid Vacation

For most homeowner’s in the Bay Area, your home is your largest asset. The great thing about owning a home from a financial perspective is that it is an appreciating asset (goes up in value over time) from which you get utility (you get to live in it!), and you get a tax benefit from […]